The European Central Bank (ECB) currently conducts a strategy review within its framework of inflation targeting that aims at consumer prices. In this context, the ECB not only assesses the effectiveness of its policy instruments but also revisits its inflation target that is at the core of monetary policy (Lagarde 2020). The ECBs toolbox to influence consumer prices includes interest rates, asset purchases and monetary policy communication. But are these policy instruments still effective in affecting consumer prices given the current environment?

The ECBs standard policy instruments include the key interest rates on its standing facilities that influence money market rates and therefore the conditions for interaction with credit institutions. The transmission of such traditional interest rates policy appears to be very heterogeneous in the Euro Area and has weakened considerably over the recent years (Altavilla, Canova and Ciccarelli 2020). In addition, conventional policy may be ineffective since interest rates in the Euro Area are negative and therefore constrained by the lower bound. Overall, the transmission of monetary policy through the interest rate channel remains uncertain with rather weak impact on consumer price inflation.

Since the conventional transmission mechanism seems to be disrupted in times of negative interest rates, the focus has changed towards other channels that work through the banking system and influence consumer prices in a different way. Changes in monetary policy affect the balance sheet decomposition and profitability of commercial banks as well as their lending behavior to the private sector, both channels appear to be particularly active (Gambetti and Musso 2017). The corresponding non-standard policy instruments include direct asset purchases on financial markets that affect prices and quantities of financial assets. The ECBs asset purchase programme had a significant upward effect on both real GDP and HICP inflation in the Euro Area during the first two years after its introduction (Gambetti and Musso 2017). Therefore, quantitative easing measures that affect the real economy through the banking system seem to be an effective tool, although it depends on the type of purchased assets.

Another unconventional instrument that may be suitable in the current environment of negative interest rates is a policy communication that influences long-term expectations about consumer prices by signaling the future course of monetary policy. A credible and transparent communication can provide guidance to market participants and stabilize inflationary developments. Such forward guidance by the ECB has stronger and more direct effect on output and inflation in the Euro Area compared to unanticipated changes in monetary policy (Christoffel et al. 2020). Therefore, a communication that manages the expectations of market participants may also be considered an effective policy instrument.

Overall, the effectiveness of monetary policy instruments has changed according to the activity of corresponding transmission channels with respect to consumer price inflation. However, the different instruments cannot be considered substitutes since their way of affecting consumer prices differs fundamentally. A larger toolbox is necessary to respond to changing market conditions and tackle the new challenges that confront the ECB in times of negative interest rates. Thereby, asset purchases and forward guidance are effective alternatives for conventional monetary policy and therefore suitable tools to affect output as well as consumer prices (Altavilla, Canova and Ciccarelli 2020; Bernanke 2020; Swanson 2021).

References:

Altavilla, Carlo; Canova, Fabio and Ciccarelli, Matteo (2020) “Mending the broken link: Heterogeneous bank lending rates and monetary policy pass-through” Journal of Monetary Economics 110 (2020): 81-98.

Beyer, Andreas; Nicoletti, Giulio; Papadopoulou, Niki; Papsdorf, Patrick; Rünstler, Gerhard; Schwarz, Claudia; Sousa, João Sousa and Vergote, Olivier (2017) “The transmission channels of monetary, macro- and microprudential policies and their interrelations” ECB Occasional Paper Series No 191 of May 2017.

Bernanke, Ben S. (2020) “The new tools of monetary policy” American Economic Review, 110(4), 943-83.

Christoffel, Kai; De Groot, Oliver; Mazelis, Falk and Montes-Galdón, Carlos (2020) “Using forecast-augmented VAR evidence to dampen the forward guidance puzzle” ECB Working Paper No 2495 of November 2020.

Gambetti, Luca and Musso, Alberto (2017) “The macroeconomic impact of the ECB’s expanded asset purchase programme (APP)” ECB Working Paper No 2075 of June 2017.

Lagarde, Christine (2020) “The monetary policy strategy review: some preliminary considerations” Speech by Christine Lagarde at the “ECB and Its Watchers XXI” conference.

Swanson, Eric T. (2021) “Measuring the effects of Federal Reserve forward guidance and asset purchases on financial markets” Journal of Monetary Economics 118 (2021): 32-53.

Supplementary Material:

Main Transmission Channels of Monetary Policy Decisions (Source: ECB)

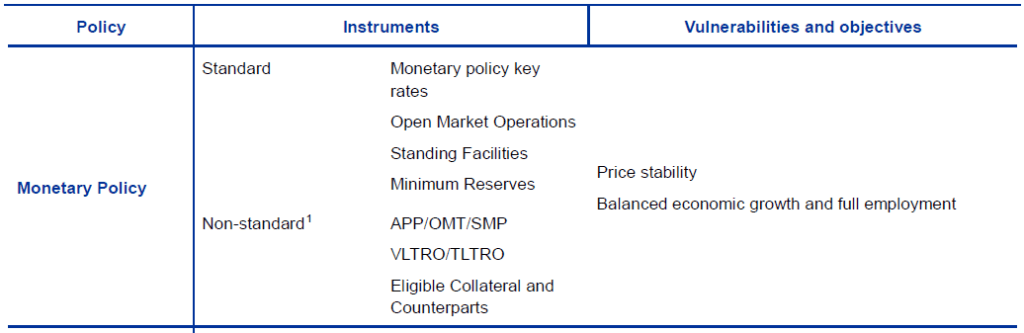

ECB Monetary Policy Instruments and Objectives (Source: ECB, Beyer et al. (2017) Table 1)

Transmission Channels

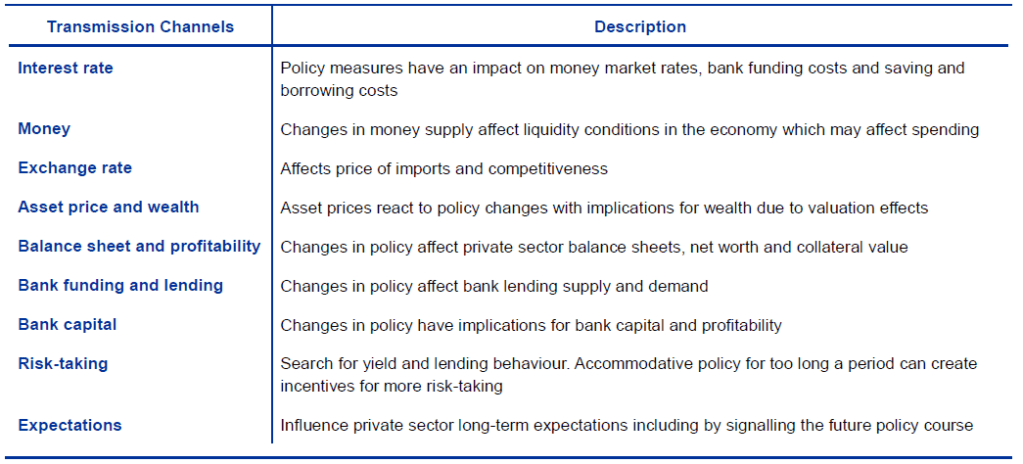

Transmission Channels of Monetary Policy Decisions (Source: ECB, Beyer et al. (2017) Table 2)

Julius Kraft, scientific staff member of the chair of Monetary and International Macroeconomics of the University of Hohenheim