The announcement effect of the European Council’s rescue plan had significantly less influence on the decline in government bond spreads than the “Whatever it takes”-speech by Mario Draghi. Still, this fiscal event has often been referred to as the Hamilton moment.

The European recovery plan covered common debt of the European member states. Therefore, it is often called the “European Hamiltonian Moment”. Both the European Commission and the member states were involved in this decision. However, the effect of this announcement to ten-year government bond was obvious weak. If this event had been a true Hamiltonian moment, the reaction to government bond spreads should have been much stronger and at least as strong as the “-speech by Mario Draghi that is often called “Bazzoka”.

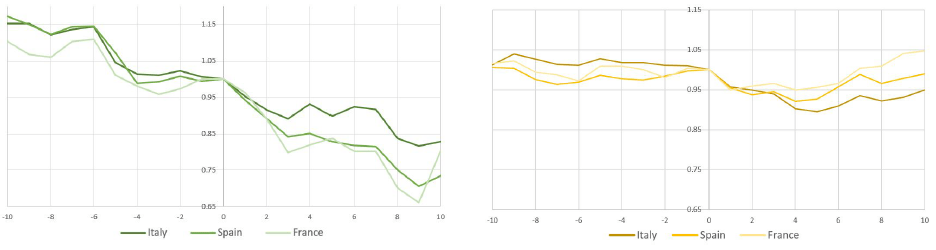

In the response to the COVID 19 crisis there was a fiscal reaction of the European Commission and of the European Council. The European Commission proposed a recovery plan as early as May 27th 2020. This led to a reduction of government bond spreads especially for largest member states France, Italy, and Spain, as seen in Figure 1. The spread for Spain was reduced by around 15 percent in the first three days following these announcements.

Figure 1: Left: Normalization of the risk spreads of ten-year government bond yield to the date of the proposal for a rescue plan by the European Commission on May 25th 2020 (ten days before and after the event), Right: Normalization of the risk spreads of ten-year government bond yield to the data of the announcement to adopt the rescue plan by the European Council on July 17th 2020 (ten days before and after the event)

The recovery plan by the Commission was adopted in a weaker form by the member states as the European Council on July 21th 2020. The resolution of the European recovery package in July is often called a “Hamiltonian Moment” (Androsch et al. 2020). Despite such framing the reaction of government bond spreads was distinctly weaker than the reaction to the announcement of the European Commission.

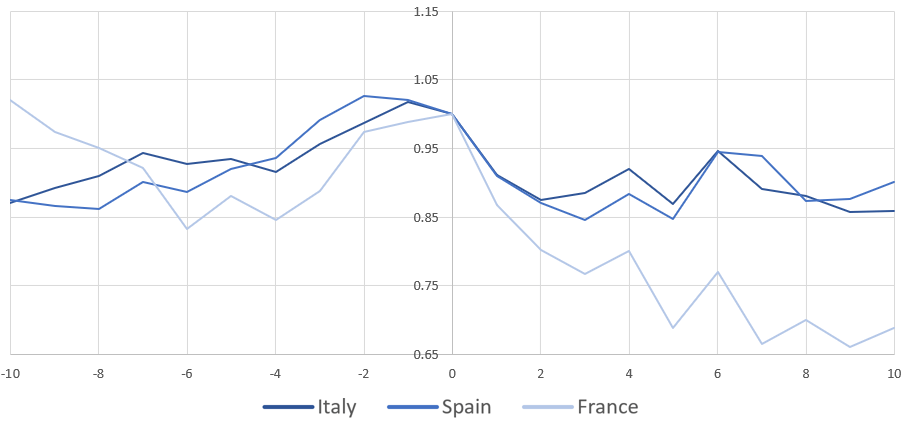

By contrast, in response to the Euro crisis, Mario Draghi gave his famous “Whatever it takes”-speech on July 26th 2012. As seen in Figure 2, the speech caused a sharp decrease of government bond spreads. Specially for France, the government bond dropped by almost 20 percent on the two days following the announcement.

Figure 1: Normalization of the risk spreads of ten-year government bond yield to the date of the “Whatever it takes”-speech on July 26th 2012 (ten days before and after the event)

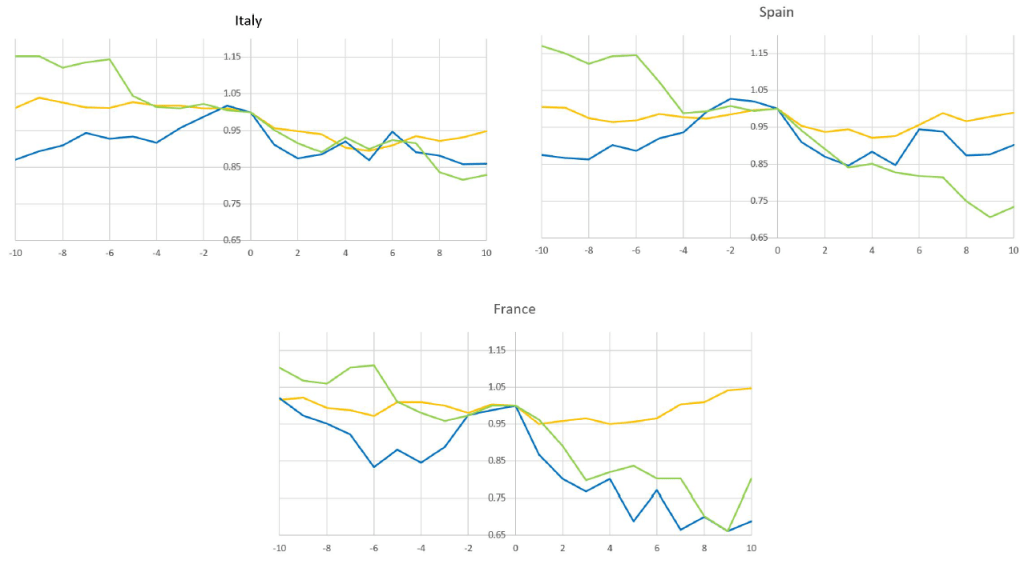

In Figure 3, we see that the effect of the “Whatever it takes”-speech dominated the effect of the announcement of proposal for a European rescue plan by the European Commission for France and Italy for the first five days. However, for Spain this was only observable for the first two days.

Figure 3: Normalized risk spreads of ten-year government bond yield for the different events (“Whatever it takes”-speech, (blue), proposal by European Commission (green) and announcement of European council (orange)) by countries

Furthermore, the decrease of bonds yields as a response to the resolution of the member states particularly in the first few days, was significantly lower than the decrease for the other two events. One might argue, the weaker the market anticipations of a political decisions were, the greater was the reaction of the market (Ehrmann and Fratzscher 2009). The announcement of the European Council to a European rescue plan was already anticipated by the markets because of the earlier proposal of the European Commission. So, the response of the markets to this announcement was considerably weaker compared to the announcement of Mario Draghi or the European Commission. Such announcements can be enough to trigger a reaction from markets. This is a well-known phenomenon in the literature such as in Romer and Romer (2010), Gertler and Karadi (2015), Nakamura and Steinsson (2018).

Additional, applied to France, Spain and also to Italy, the effect of the “Whatever it takes”-speech on the government bond spreads was larger relative to the effect of the announcement of the European recovery plan by the member states. If the European rescue plan was a “Hamiltonian Moment”, than Mario Draghi speech was one as well in term of bond yields.

All monetary and fiscal events considered led to a decrease of risk spreads for government bonds. Nevertheless, they differed in their strength of the responses. A sharp reduction of bond yields was more likely, if the markets considered the statement to be credible. Here, the monetary event of the “Whatever it takes”-speech of Mario Draghi resulted in a faster and more forceful response than the other two fiscal events. The recovery plan by the European Council led to the weakest decline of spreads. However, the magnitude of the announcement effect of the rescue plan proposal by the European Commission was similar in size to the “Whatever it takes”-speech of Mario Draghi.

Literature:

Androsch Hannes, Anders Åslund, Jörg Asmussen, Lorenzo Bini Smaghi, Michael J. Boskin et. al. 2020. “Did Europe Just Experience Its “Hamiltonian Moment”?”, The International Economic Policy Magazine, Summer 2020: 12-35.

Ehrmann, Michael and Marcel Fratzscher. 2009. „Explaining Monetary Policy in Press Conferences,“ International Journal of Central Banking, vol. 5 (2): 42

Gertler, Mark, and Peter Karadi. 2015. „Monetary Policy Surprises, Credit Costs, and Economic Activity.“ American Economic Journal: Macroeconomics, vol. 7 (1): 44-76.

Nakamura, Emi and Jón Steinsson. 2018. „High-Frequency Identification of Monetary Non-Neutrality: The Information Effect,“ The Quarterly Journal of Economics, Oxford University Press, vol. 133(3), 1283-1330.

Romer, Christina D. & David H. Romer, 2010. „The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks,“ American Economic Review, American Economic Association, vol. 100(3), 763-801.