When the central bank of the United States takes monetary policy decisions there are direct economic implications for the Euro Area. The impact of increasing interest rates on industrial production and consumer prices in the Euro Area is small and positive. These contractionary monetary shocks also lead to a Euro appreciation and a deterioration of the trade balance.

What is the economic impact of interest rate changes in the United States on the Euro Area? Both economies are closely connected through trade in goods, services and financial assets. As a result, economic shocks such as monetary policy decisions do not only affect the domestic economy but also have an international dimension. An empirical analysis allows to depict the economic impact of monetary surprises in the United States on interest rates, industrial production growth and consumer price inflation in the United States as well as the Euro Area.

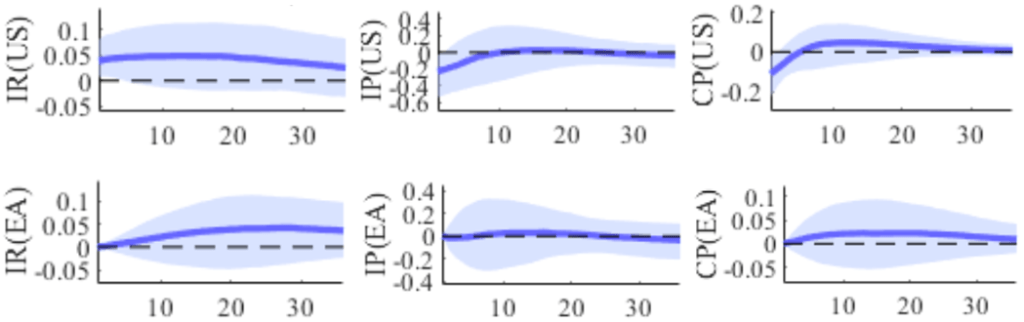

The derived empirical evidence suggests that monetary disturbances in the United States have sizeable implications for the domestic economy but the direct economic impact on the Euro Area seems to be limited. Specifically, the median monetary policy shock is associated with rising interest rates by a maximum of 4.9 percentage points in the United States. The Euro Area responds with percentage point increases of up to 4.2 in interest rates, 3.3 in industrial production growth and 2.2 in consumer price inflation. It further becomes evident that positive interest rate shocks transmit internationally through increased commodity price inflation, a Euro appreciation relative to the US-Dollar as well as a trade balance deterioration from European perspective.

In fact, the obtained monetary spillover effects are relatively small compared to the influence of domestic disturbances. However, the analysis further shows that the impact of foreign shocks has been changing over time with considerable contributions during certain periods. Overall, the empirical findings demonstrate that domestic disturbances explain most economic fluctuations. Given the close co-movement of both economies it is nevertheless indicated to monitor foreign policy decisions and anticipate corresponding shocks to reduce business cycle fluctuations. When it comes to the international transmission of economic shocks, both the trade and exchange rate channel transfer monetary disturbances between the United States and the Euro Area.

The discussed empirical evidence is part of a broader analysis of monetary spillovers from the United States to the Euro Area that is available upon request. The obtained insights provide a starting point to further explore the international impact of economic policy decisions on large and open economies or investigate the potentially asymmetric effects on Euro Area member states with respect to their economic integration. The international transmission of monetary policy has been analysed in comparable frameworks for example by Kim (2001) and Neri & Nobili (2010). The transatlantic implications of monetary policy remain under investigation, examples for recent research from the European Central Bank include Ca‘ Zorzi et al. (2020) and Jarociński (2020).

Literature:

Ca‘ Zorzi, Michele & Dedola, Luca & Georgiadis, Georgios & Jarociński, Marek & Stracca, Livio and Strasser, Georg (2020). “Monetary policy and its transmission in a globalised world” ECB Working Paper Series No. 2407.

Jarociński, Marek (2020). “Central bank information effects and transatlantic spillovers” ECB Working Paper Series No. 2482.

Kim, Soyoung (2001). „International transmission of US monetary policy shocks: Evidence from VAR’s“ Journal of Monetary Economics, 48(2), pp. 339-372.

Neri, Stefano, and Nobili, Andrea (2010). „The transmission of US monetary policy to the Euro Area“ International Finance, 13(1), pp. 55-78.

Julius Kraft, scientific staff member of the chair of Monetary and International Macroeconomics of the University of Hohenheim