The Recovery Plan has been celebrated as the European Hamiltonian moment. Financial markets also responded to the negotiations and the announcement on July 21st. Whether it is a true completion of the monetary and fiscal union, however, remains questionable to the markets.

Special European Council meeting concerning the necessary financial support for a recovery of the European member states during the Corona Pandemic took place in July. After long discussions, the European leaders agreed upon common support in form of the Recovery Fund. Financial aid will be paid out from 2021 to 2027. This common recovery fund has been celebrated as the European Hamiltonian moment. If this is a true completion of the monetary and fiscal union it is also questionable to the financial markets. However, the announcement of the agreement led to a change in the expectations and behavior of the market participants and created different market responses.

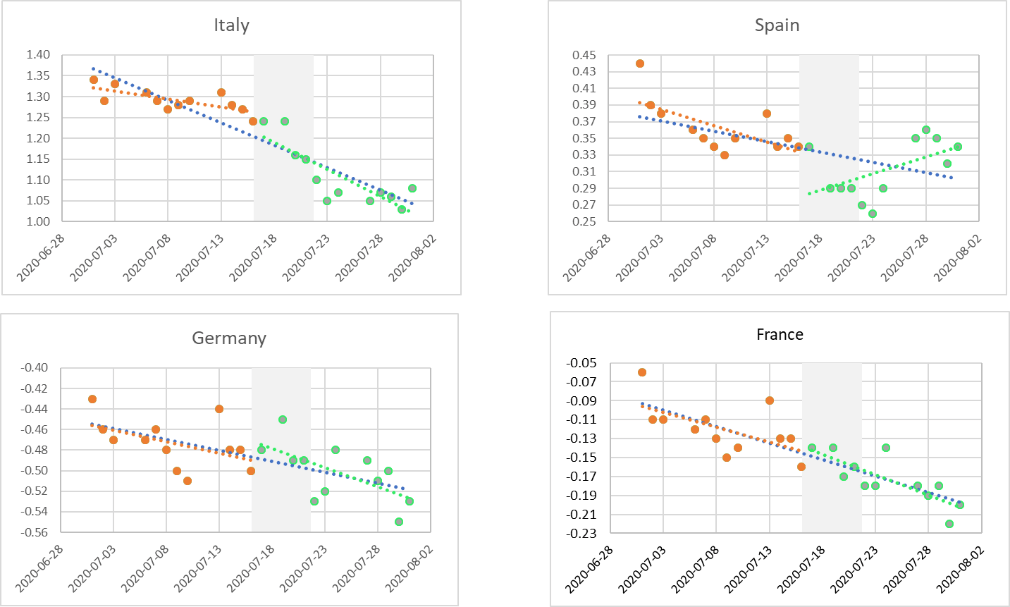

government bond data before and after the meeting (grey shades are the days (17 to 21 July 2020) of the European council meeting)

One financial market response to the recovery fund was a decrease of the ten-year government bond yields. The yields of Italy or Spain dropped roughly between the 17 and 23 July. The Special European Council meeting had a significant effect to Italian and Spanish ten-year government bonds. However, the effect on the Italian and Spanish bond yields by the monetary bazooka effect was stronger as the fiscal recovery fund effect. Also, the values for France and Germany diminished as a consequence to the recovery fund, but not as significant as the other two. Nevertheless, the observed effect on the bond yields could be a European impact because either the United States or the United Kingdom had a significant effect on their bond yields in July.

An additional market response can be seen at the risk spreads of the government bonds relative to the German government bond. After the agreement the risk spreads for France and significant for Italy and Spain declined as well. During the meeting and the following days, the risk spread for Spain was below its average of this month.

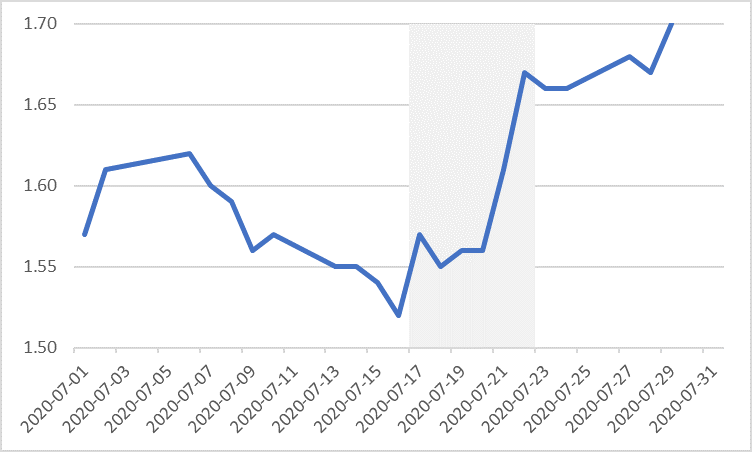

Furthermore, the Euro appreciated after the agreement and the next few days to 1.16 US-Dollar to Euro. This is an appreciation of more than one percentage point. For comparison, the Euro has also appreciated by one percentage point as a reaction to Mario Draghi’s “Whatever it takes”-speech in 2012. The announcement of the recovery fund arises the market expectations that the stability of the European Union increases. So, the Euro appreciated.

The new budget and the recovery fund drive the anticipation of a rapid and sustainable rebound of the European economy. This is a sign for a rise in confidence, credibility and functionality of the European Union. Thus, the inflation expectations of the market participants grew towards the inflation target of the European Central Bank. As well it is noticeable that the all stock indices for France, Spain, Italy, Germany and European Union decreased after the agreement and the consecutive days between 0.5% and 2%. The realization of the expected agreement between the European leaders led to a sale of stocks. This could also be a market response to the agreement.

European council meeting)

The announcement effects of a press conference on data are a well-known phenomenon in the literature like Romer and Romer (2010), Nakamura and Steinsson (2018), Gertler and Karadi (2015). Ehrmann and Fratzscher (2009) emphasize the less the market anticipates the political decision, the greater is the reaction of the market.

All in all, there are observable market responses of the Special European Council meeting in the data. So, the announcement of this political agreement without any implication of this agreement in form of a real payment is enough to evoke market responses. The market response to the recovery fund was not as strong as it would have been if a fiscal union had been established. The reasons therefore are the temporary nature and the absence of a true common financing policies of the common recovery fund like sovereign European taxation.

Literature:

Ehrmann, Michael and Fratzscher, Marcel. 2009. „Explaining Monetary Policy in Press Conferences,“ International Journal of Central Banking, vol. 5 (2): 42-84.

Gertler, Mark, and Peter Karadi. 2015. „Monetary Policy Surprises, Credit Costs, and Economic Activity.“ American Economic Journal: Macroeconomics, vol. 7 (1): 44-76.

Nakamura, Emi and Steinsson, Jón. 2018. „High-Frequency Identification of Monetary Non-Neutrality: The Information Effect,“ The Quarterly Journal of Economics, Oxford University Press, vol. 133(3), 1283-1330.

Romer, Christina D. & Romer, David H., 2010. „The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks,“ American Economic Review, American Economic Association, vol. 100(3), 763-801.

Victoria Sophie Krautter, scientific staff member of the chair of Monetary and International Macroeconomics of the University of Hohenheim